Value Stacking with Distributed Energy Resources

The traditional means of providing electricity to customers is changing. Rather than only large, central power plants delivering all of our electricity, resources located at consumer premises, called distributed energy resources (DERs), are supplying an increasing amount of energy needs.

As these DERs, including solar power, energy storage and energy management systems, further proliferate, opportunities open to provide value beyond electricity. They offer a variety of services that allow them to receive forms of revenue and compensation, known as value stacking, by providing benefits to customers, utilities and the grid.

One benefit is that when DERs are aggregated and controlled together, they can offset traditional generation resources. They also can reduce and shift electrical load on-site to lower monthly utility bills and avoid peak demand charges. They further have the potential to provide services to the grid, such as improved management of demand response and participation in wholesale energy markets to help regulate power, particularly useful for balancing the intermittent patterns of wind and solar generation.

However, as a relatively new concept, DER aggregation and value stacking face significant challenges, and technical frameworks have not been well established to allow them to provide the full range of their services.

To help define the value of DERs, CSE is leading a demonstration project funded by the California Energy Commission’s Electric Program Investment Charge that is aggregating DERs located at multiple customer locations. CSE is then bidding them into the California Independent System Operator (CAISO) energy and ancillary service markets with the goal of identifying revenue streams and finding solutions to certain regulatory, technical and institutional barriers that currently block greater DER penetration.

The experiences and lessons learned through this project will be broadly shared with industry, utility and regulatory representatives at the project’s conclusion in late 2020. While this pilot project focuses on host sites in California, the findings will be generally applicable nationally as utility customers are increasingly looking to DERs to reduce energy costs and electricity markets are faced with integrating more renewable energy resources.

Project Details

The primary goal of this demonstration project is to develop operational strategies that allow behind-the-meter DERs to be bid directly into the CAISO day-ahead and real-time energy markets—primarily as proxy demand resources—while still maintaining their intended value and service to customers. In addition to CAISO’s energy markets, the project’s two portfolios will demonstrate new forms of market participation for behind-the-meter DERs—providing spinning reserves and simulating frequency regulation. In addition, the project will use direct metering for energy storage systems, which is a rarity among nongenerating resources in CAISO markets to measure resource performance for market settlement purposes.

The project consists of two portfolios. Portfolio 1 is an aggregation of five public school facilities, each with behind-the-meter solar PV paired with battery energy storage. Portfolio 2 includes two hotels outfitted with an array of wireless sensors and dynamic controls utilizing advanced energy management software.

Portfolio 1 – Chino Hills

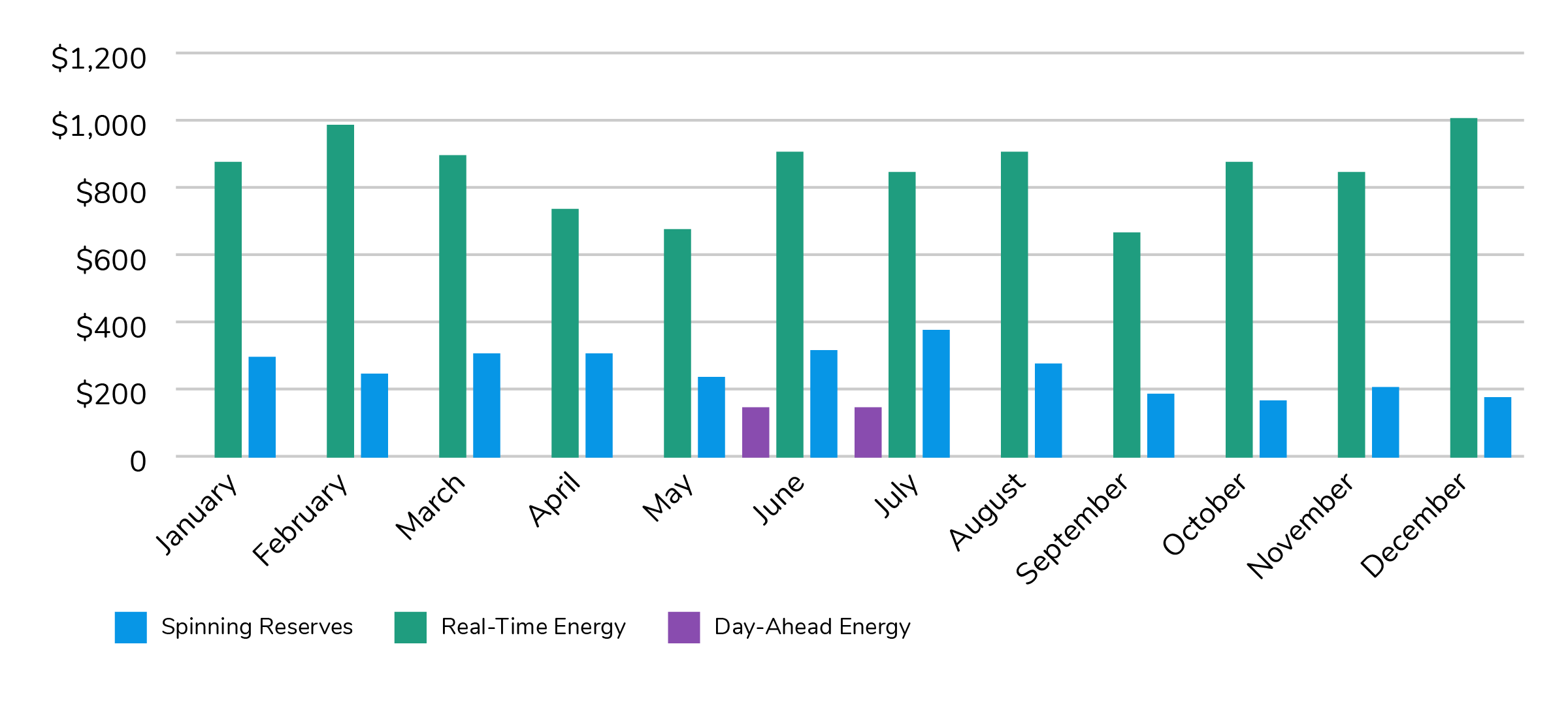

The five public school facilities aggregated to form Portfolio 1 are located in Chino Hills, Calif. Each school has behind-the-meter solar PV and Tesla Powerpack battery energy storage systems with a combined capacity of 1.1 MW/2.09 MWh and submetering for performance evaluation. Battery dispatch is optimized to participate in the day‐ahead and real‐time wholesale energy market based on the retail tariff, forecasts of net load, potential market award and imbalance charges (i.e., market penalty). Figure 1 shows potential wholesale market revenues for this portfolio.

Figure 1: Portfolio 1 potential wholesale market participation revenues

In addition to providing energy into the day-ahead and real-time markets, Portfolio 1 also will provide ancillary services in the form of spinning reserves and frequency regulation simulation. While CAISO allows proxy demand resources to provide spinning reserves, it does not allow them to provide frequency regulation; therefore, the portfolio will bid spinning reserves into the market, and it will simulate frequency regulation by following actual regulation signals.

These additional services will show how DERs can tap into multiple revenue streams in the wholesale market and the value they can provide. To date in California, few DERs have provided spinning reserves into the CAISO market, making this demonstration one of the first of its kind. Moreover, if the frequency regulation simulation is successful, this could be an opportunity to advocate for proxy demand resources to provide regulation in the market.

This project is also using a newly developed metering methodology at CAISO, known as metered generator output (MGO), to directly meter the energy storage systems for performance and settlement purposes. MGO differs from traditional retail demand response (DR) programs that utilize whole-premise metering (typically the electric utility distribution company’s revenue/billing meter) to baseline the performance of load curtailment during a given DR event. Under this configuration, the batteries are submetered to determine performance during a DR event. A feature of this demonstration project will be to test the ability of MGO as a mechanism to ensure accurate compensation of behind-the-meter storage for its contributions to a DR event dispatch.

Partners on this project include Avery Energy Enterprises, Lawrence Berkeley National Laboratory, ICF International, California Labor Management Cooperation Committee, California Labor Federation, ASWB Engineering, UC Davis California Lighting Technology Center and Energy Solutions.

Portfolio 2 – San Diego

Portfolio 2 consists of two hotels located in San Diego and uses advanced energy management software developed by Conectric Networks to evaluate whole-premise metered performance. The two sites combined can reduce on-site load by up to 215 kW/1,300 kWh. Both hotel facilities are outfitted with thousands of lighting, thermal and occupancy sensors throughout the common areas and guest rooms that are Wi-Fi-connected to Conectric’s dedicated local area network gateway hubs, along with automated smart controls placed “over the top” on HVAC equipment (that had preexisting equipment management system controls of their own) and lighting switches.

Figure 2: General view of the Wi-Fi-enabled sensors and controls (via dedicated smart gateway hubs) outfitted in Portfolio 2 hotel facilities

To provide both retail and wholesale services, Portfolio 2 includes load management strategies, a list of necessary data points to collect, a data collection and load control protocol and protocols to perform automated load management responses to varying grid conditions. Portfolio 2 has two primary methods to strategically manage site loads when participating in the wholesale market:

- Load shift by primarily using the building’s thermal mass as passive thermal energy storage

- Load shed when peak-demand economic conditions merit additional reductions

Specific load management strategies that Conectric Networks plans to implement to deploy both load shift and load shed across both hotel facilities include the following.

Occupancy forecasting: Using detailed analysis of historical occupancy patterns provided by the hotel, probabilities will be assigned to the occupancy of a specific use area. For example, only 1% of rooms are occupied between 3‒4 p.m., increasing to 48% between 4‒5 p.m., and 74% between 5‒6 p.m. The amount and duration of cooling load shifting in guest rooms can be matched to the occupancy probability.

Precooling strategies: The thermal characteristics of each zone and of each building as an aggregate compared to weather data and available heating and cooling capacity can determine the amount and duration of precooling required to deliver a certain reduction in cooling requirement at a later time. This fits with the demand shifting or thermal energy storage function.

Ventilation control: Ventilation is often left uncontrolled or based on schedules not regularly updated. By adding occupancy information to ventilation control, it may be possible to manage ventilation to perform energy load shifting, shedding or shimmy functions.

Pump control: Hotel buildings have sizable water management systems designed to pump, distribute, heat, cool and treat water. Some of the many water features include swimming pools, chillers for air conditioning and boiler systems for hot water and heat—nearly all of which can be managed for energy load optimization. For example, it may be economically favorable to turn off water pumping functions for a certain period to perform load shift or shed if the forecasted wholesale market price crosses a certain threshold. Or another example may be if rooms are unoccupied for multiple hours it may be unnecessary to pump as much hot water through portions of the facility.

Lighting controls: Customers typically find it difficult to control common area lighting because lighting systems in those areas tend to be connected to a single on/off switch. A user interface with over-the-top network of subswitches or dimmers can be installed to make it easier to create individual lighting branch control.

Partners on this project include Tesla, Conectric Networks, Olivine, Inc. and DNV GL.

Portfolio Timelines

Portfolio 1 is currently in the process of registering its resources into the CAISO wholesale market. The project team anticipates it will be ready to begin market participation in summer 2019. Portfolio 2 is in the customer agreement phase, and the project team is hoping to begin market participation by late summer 2019. The project team will observe and analyze both portfolios participation in the market into early 2020.

Conclusion

With declining costs and rapid technology advancements, DERs are increasingly being adopted by customers to provide utility bill savings. Beyond customer bill savings, DERs can provide numerous benefits to utilities and grid operators. However, the multiple use application of DERs is a relatively new concept that has not been deployed on a large scale. Many technical, regulatory and institutional questions must be addressed to develop viable frameworks, markets and policies that allow for multiple-use applications. Additionally, the existing workforce is not adequately trained on these types of technologies and value streams.

Through these two pilots, CSE hopes to inform the industry and stakeholders on the market integration steps and operational strategies of multiple-use application DER portfolios participating in utility programs and wholesale markets. Additionally, CSE hopes to refine training and educational materials that can train the existing and future workforce to become skilled with DER technologies and the practice of value stacking. With the lessons learned from these pilots, the project team plans to inform stakeholders on policies and practices that can allow DERs to provide greater benefits to customers and the overall energy grid.

---------------------------------------

For more information about unlocking the value of DERs, read the white paper, Maximizing the Grid Benefits of Behind-the-Meter Energy Storage.